Tech Things: More Windsurf Drama

Here's a nice, clean story that you might want to tell to founders in Silicon Valley.

If you work hard and you read the market and you get a bit lucky, you will build a company that is successful. That company will be composed of shares, and those shares will each have some nominal value. If you are successful enough, someone will come along to buy your company. They will look at the number of shares you have, and the share price for each share, add that all up, and then give you a big pot of cash. And you will say, "Thank you for this big pot of cash", and you will distribute it all to the owners of those shares in proportion to the number of shares they own. And then the acquirer will take your company and you will take whatever is your portion of the big pot of cash and then you will go on your merry way.

This is a nice, clean story. And like all nice, clean stories, it is rather misleading. There's a few obvious reasons why things may not work out like this.

You (and your employees) are part of what makes the shares of your company valuable. Your acquirer will likely want you (and your employees) in addition to whatever you have built, so you can't just walk away.

Your acquirer may not have a big enough pot of cash just lying around. They may want to give you some other things besides cash, like other forms of equity, which may have way less liquidity than a US dollar.

Your acquirer may not actually think you're worth as much as you think you are, and may try to give you a significantly smaller pot of cash. This in turn may make your investors and your board mad, such that you are no longer allowed to sell the company at that price.

More generally, this is a free negotiation, which means anything and everything is on the table. You want to get a big payout and walk away. They want you to take as small a payout as possible and come work for them. You want the acquirer to give you a house in Hawaii. They want you to come to work dressed like a clown every Tuesday. Welcome to the world of M&A.

Even though every acquisition is different, when a successful startup is being bought by an even bigger and more established company you're really only negotiating on two things.

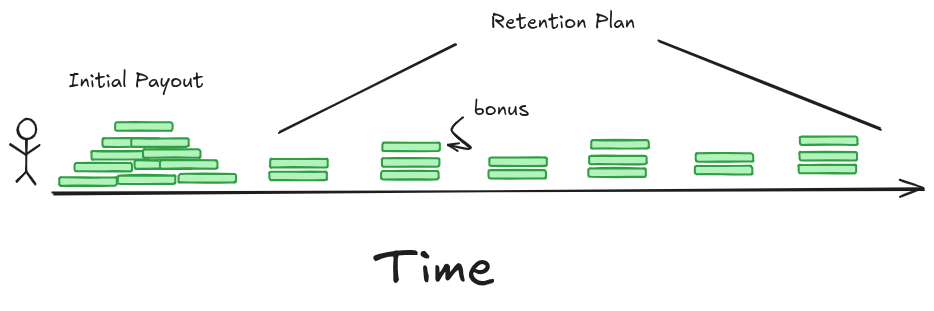

You can negotiate on the size and form of your initial payout. Do you get cash or stock or some other thing? Are there any strings attached (NDAs, 'good behavior' clauses, non-competes, non-solicits)? Are your unvested shares treated as yours for the purposes of payment?

You can negotiate on the 'retention plan'. How long do you have to keep working at the acquiring company? In what capacity? How do they incentivize you to stay and actually, like, be interested in working on things instead of spending all of your time on the roof of the building suntanning?

For the most part, founders and key members will get a pretty sizable initial payout. This is normally a 1:1 trade of stock for cash or stock for stock of equal value. Normally, there is some chunk of this payout that is liquid. The startup's shares may be worth a lot on paper, but you cannot use them to, like, pay rent or buy a sandwich. So when you sell the company, you often want to finally turn some of those shares into sandwich money. If you are being acquired by a public company that gives you stock, you can take your stock and immediately sell it for cash, and then trade the cash for sandwiches. If you are being acquired by a private company, their stock is also not going to be liquid, and so private-to-private acquisitions often involve some cash exchanging hands.

Retention plans are really variable. Generally, the acquiring company wants founders and key members of the startup to stick around. One way to have you stick around is by paying you a lot of money. Another way is to hold back the money/stock that you would have gotten for your shares, and pay out over some number of months/years instead of all at the beginning. The usual outcome is somewhere in between these extremes — the acquirer will hold back some amount of the value of the initial shares and pay that out over a 2-4 year period, and will also add some value on top so that it's not just a blatant delaying tactic. And if you get laid off, you immediately get the retained payout.1 2

I wanted to include all this background, because it's useful to have a sense for what 'normal' looks like. None of what follows is really normal at all.

A few weeks ago I wrote about OpenAI acquiring Windsurf for a cool $3b. For folks who are coming to this story late, Windsurf is (was?) an AI-integrated coding editor, more or less a direct competitor to Cursor. And OpenAI is of course OpenAI, if you don't know what that is, what are you even doing, do you live under a rock?

I didn't really understand why OpenAI was acquiring Windsurf. OpenAI was spending a pretty absurd amount of money on a tool with limited technical moat and far less usage and brand recognition than its primary competitors. Back in April, in my second most popular article, I wrote:

The real issue with all of these products is that they are too easily verticalized. Anyone who wants to spin up a version of Windsurf with one slight change that targets a tiny market segment can do so fairly easily. That means the addressable market for any of these companies may actually go down over time as more competitors and free alternatives enter the market, even as the number of "programmers" goes up. In point of fact, even though I love the ingenuity behind Cursor (which really spearheaded the current AI coding paradigm) I have openly said that their long term opportunities are slim. Even though Cursor had significant first mover advantage, they have no moat or stickiness. As with the rest of the AI market, switching cost remains extremely low, and there is simply no reason to use Cursor when you can use a free version or one with better enterprise support.3 Cursor isn't even living on its own platform — it's a fork of VSCode. I am personally convinced that their only long term exit opportunity is an acquisition by Microsoft, and even that seems less and less likely as Satya puts more resources into the already-VSCode-native Copilot as a real competitor.

All of which makes the $3B price tag for Windsurf seem eye wateringly high. Compared to Cursor, Windsurf has fewer users, has been around for less time, has less brand recognition, and has diminishing prospects for future growth. It’s not as tied to VSCode, which is a plus, I guess. But it all begs the question: why on earth is OpenAI paying so much?

To make matters worse, everyone who's using Windsurf is almost definitely using Claude or Gemini. Even though the "GPT wrapper" term was always meant as an insult, it is in practice a huge table stakes feature to be able to wrap around many different LLM providers. That flexibility is what allows a company like Windsurf to ride the machine learning wave, buoyed along by everyone else's investments. Cursor really only took off when Claude suddenly got really good at programming, after all. If Windsurf ends up being tied exclusively to GPT, many of its users may leave the platform simply because it is now a worse platform. But if there isn't any vendor lock in, we're back to square one — what is the point?

Well, maybe someone at OpenAI reads this blog (hi Sam! 😘), because not long after I posted that article the deal got cancelled. It's still unclear why it got cancelled, but, like, it has to be OpenAI backing out, right? $3b is an obscene amount of money! Still, M&A deals fail all the time. No harm no foul, life moves on.

And then things got weird.

Google swept in and acquired the company for $2.4b. Except wait, no they didn't! From Reuters:

Google has hired several key staff members from AI code generation startup Windsurf, the companies announced on Friday, in a surprise move following an attempt by its rival OpenAI to acquire the startup…

Google is paying $2.4 billion in license fees as part of the deal to use some of Windsurf's technology under non-exclusive terms, according to a person familiar with the arrangement. Google will not take a stake or any controlling interest in Windsurf, the person added…

Unlike acquisitions that would give the buyer a controlling stake, these deals do not require a review by U.S. antitrust regulators. However, they could probe the deal if they believe it was structured to avoid those requirements or harm competition. Many of the deals have since become the subject of regulatory probes…

The majority of Windsurf's roughly 250 employees will remain with the company, which has announced plans to prioritize innovation for its enterprise clients.

O…kay. So this is obviously sketchy. OpenAI was going to buy Windsurf in a standard acquisition and backed out. And then Google came in and paid the key employees a bunch of money to join Google, but basically said they didn't want the company, IP, or anyone else. It's less an acquisition and more a form of really aggressive poaching? I don’t think there’s a good name for these yet, so I’ve taken to calling these cherrypick deals.3

This isn't the first time a cherrypick has happened — for example Meta recently pulled something similar with Scale.ai. But I think it's a really bad precedent. In my third most popular article, I discussed this trend:

The Meta / Scale deal is extremely similar to the Google / Character.AI deal from last October, and the Microsoft / Inflection deal from last March. In both of the latter two cases, the purchasing investing megacorp paid out a hefty sum to poach all of the talent, leaving the startup a shell of its former self. Technically still alive; in practice, a zombie. The poached talent ends up doing fairly well, landing sweet gigs as the leads of key innovation arms at the megacorp. The people who are left behind? Not so much. One of the big criticisms of the Google deal was that the founders made out like bandits — Noam, for example, is now one of the leads on Gemini and is likely clearing 8 figures in salary — while the remainder of the 150-person-staff at Character got screwed. Even though Character AI technically raised money, it was clear that the actual value of the extremely non-liquid Character AI stock had gone way down because all the people who made that stock valuable left as part of the deal…

I don't think this kind of 'investment' will ever become super common, since it rarely makes sense for an acquirer to acquire in this way. But I will say that I am not happy this has happened three different times, and I'd hate for this to be precedent-setting. Joining a startup is already a risky proposition. As a founder, you are making a promise to your employees to do right by them. Abandoning them for riches while they stay on a sinking ship feels gross to me.

And other folks like Matt Levine (Money Stuff) and Ben Thompson (Stratechery) have jumped in with similar takes about how cherrypicking founders is bad for everyone else in the ecosystem:

Like, why should Google cash out your investors? It doesn’t care about the corporate shell of your company; it might not even care that much about your product. It just wants you. Because you own a lot of equity in your company, it has to cash out your equity to get you to move, but why does it have to cash out your investors’ equity?

You could imagine this being the norm, but it’s a bad norm. Who would ever invest in a hot AI startup, if they knew that their investment would become worthless if Google made the founder a better offer? If the venture capitalists are giving you money, it’s because they want to bet on you, not just whatever product you happen to be working on right now. If Google could buy you away without paying them, that would not be a very good bet.

The fact of the matter is that picking-and-choosing who to hire from a failed startup is great for Big Tech: they get the IP they want and the employees that matter, and get to jettison everyone else without having to do a future layoff. That they never thought to do so previously was, in retrospect, downstream of “the way things are done”, not some sort of legal requirement; once the law, in the form of over-eager regulators who didn’t understand what they were regulating, gave them no choice, it’s not at all clear why they would go back to the old model.

The people who are getting screwed, however, are the folks who were never necessarily going to get rich — that’s reserved for founders, and appropriately so — but who could justify rolling the dice on a positive outcome as long as they had downside protection in the form of guaranteed employment with a Big Tech company if things didn’t work out.

At least the Windsurf investors got paid! This suuuuuuuuuuucks for the Windsurf employees who got left behind.4 Maybe Windsurf could have survived on its own, but come on. It's hard to build a company when you've been decapitated.

A little bit after the Google deal, Cognition Labs (the makers of Devin, which is a bit like Claude Code, which is a bit like Windsurf, which is a bit like Cursor) came in and actually acquired the company. And while the terms of that deal are unclear, it's likely they were able to snag Windsurf — like actually buy out all of Windsurf's shares — for pennies on the dollar, or possibly nothing at all since the biggest shareholders and investors had already been paid out by Google. Apparently the deal went through over the course of a single weekend.

This is a massive win for Cognition. As far as I can tell, Cognition is an incredible engineering team in need of a sales arm. Meanwhile, Windsurf is a very strong sales team that just had their core engineering gutted. And it’s a good product fit too — Cognition’s core product is a remote async agent, which pairs well with Windsurf’s on-client synchronous agent. For Cognition, this is like finding a Lamborghini at a garage sale.

Still, this is probably a bittersweet outcome for the remaining Windsurf team. If I was a Windsurf employee, I would've been pretty pissed watching the Windsurf executive team take billions of dollars to leave me behind on a sinking ship. Definitely uninvited to the next boardgame night.

Except wait, maybe not! The latest twist in this telenovela is that apparently the Google deal was maybe not so great?

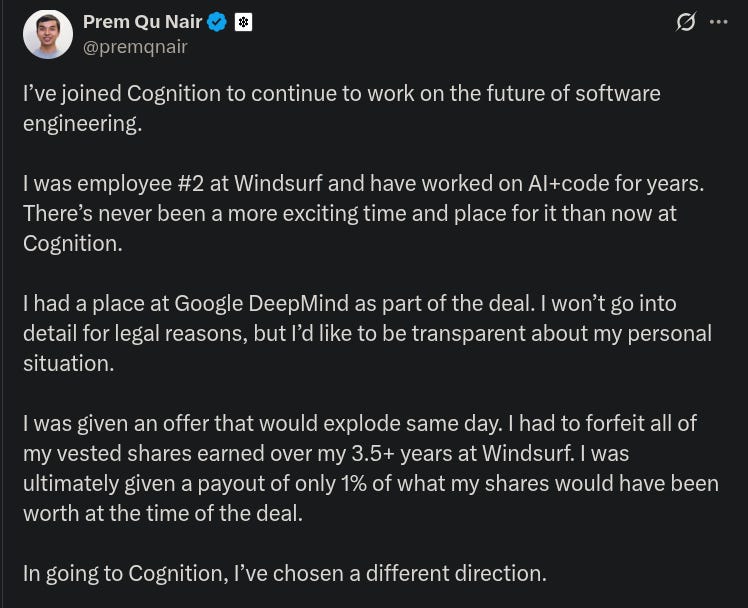

What is going on? I mean, it looks like Google gave him 1 day to make a decision, which is not a great look but also not unheard of, whatever. But what does Prem mean that Google was only paying out 1% of the worth of the stock? They supposedly paid 2.4 BILLION DOLLARS. With a B! Where did all that money go?

Then it gets weirder. My sources say that this deal was filled with all sorts of legal drama on both sides, and everyone is now under a super tight NDA. The big sticking point seems to be that anyone who joined Google from Windsurf lost all of their vested Windsurf stock, and instead got brand new Google stock grants, with a vesting schedule reset over 4 years. Prem had been at Windsurf for 3.5 years, so he was probably about fully vested. If he joined Google, he'd supposedly lose it all, and would have to "re-earn" the same stock over the next 4 years, with no guarantee that he would not be laid off in the middle.

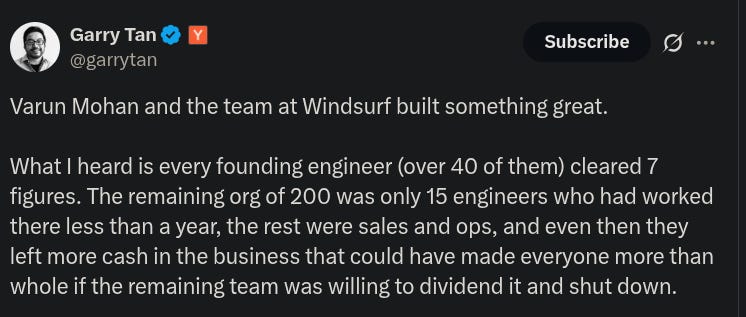

To make things even more confusing, I also found a tweet from YC CEO Garry Tan indicating that Prem should have gotten a hefty payout.

I'll be honest, I personally am still trying to reconcile all this.

Let's say Prem had 1% of the company. If Google 'acquired' 100% of the company for $2.4B, Prem's Windsurf stock ought to be worth $24M dollars.

In the traditional setting, Prem would get some amount of dollars immediately, and then get paid out the rest in a retention plan over several more years. Apparently, in the real world, the amount that he was going to get immediately was 0. And if I'm understanding the deal correctly, he should have gotten $6M in stock over the next four years, totalling his $24M. That's definitely not a great acquisition deal. No initial payout sucks. A four year vest with no added kicker sucks. And you have to pay taxes on all of that without any beneficial tax exemptions because it's all new grants, which of course sucks. But also, these are fantastic problems to have? I would love it if someone's lowball offer was $6M per year!

But Prem is saying that he wasn't getting $24M per year. He was given a payout that was worth "1% of what his shares would have been worth at the time of the deal." If his original stock grant was 1% of the company, a simple reading is that he was getting 1% of that, which would be 240k. Split up over 4 years, it's only 60k a year. Now that really is absurdly low. Strictly speaking, 60k per year is better than nothing, but a talented AI engineer behind one of the hottest startups on the market could do way better.

Here's my best attempt to square everything.

the usual 4 year vest occurs on a monthly cadence;

Prem would have been receiving 1/48th, or ~2%, of his original stock value on day 1;

Prem is almost definitely in the highest tax bracket and would be paying ~50% tax rate, which would drop the stock value to 1%;

So Prem is framing his first vesting date post tax as his ‘payout’.

If you squint, this kind of makes sense. But honestly this requires a pretty tortured reading of Prem's initial post. And he's still potentially leaving a ton of cash on the table.

The really weird thing about all of this is that we’re hearing about this gossip at all. For a deal like this there is normally so much money being thrown about that everyone is more or less incentivized to keep the peace. Maybe that’s the real story — that Google for some reason screwed up by not simply offering up enough money, even though it obviously has the additional capital.

Anyway, idle gossip aside, my main takeaway from all this is that the complete absence of government regulators and the AI talent wars are together causing a total breakdown of Silicon Valley norms. Everything, from the insane comp deals to the bizarre terms, is only possible because the big tech companies are doing some pretty crazy risk / reward analyses. And it seems like it's going to last — this is now the fourth cherrypick deal in the last two years. To paraphrase a bit, once is happenstance, twice is coincidence. But four times? That's a trend.

I suspect more will come out on the Windsurf story soon. If anyone else knows anything, please feel free to reach out!

As a final coda to this whole story, I got a bit of funny news on the Google side. My network tells me that the ex-Windsurf folks are now basically rebuilding Windsurf in-house as part of Gemini. You know, because Google didn't actually buy Windsurf, so it has to start from scratch. But also, this is kind of bizarre? I'm not really sure why they are doing this. Google has a fantastic in house code editor called Cider, and it's had built-in Gemini support for at least the last three years. In other words, Google already pays an extremely accomplished team that knows how to build IDEs with AI support. So I pose the same question to Google that I originally posed to OpenAI: why did you acquire Windsurf?

Still, let this be a warning shot for anyone who is working in the AI-IDE space — Google is on track to release their own IDE, likely slated for Q4 2030.

Taxes also complicate this whole thing. There’s a bunch of different tax outcomes that can trigger depending on whether you have common stock or options, and whether you get cash or equity. I didn’t get into all of that here, but suffice to say the tax implications can result in a 50% or more decrease in your expected outcome. That can sometimes be a tough pill to swallow on its own.

Another thing I left out for simplicity is that the particulars of the compensation deal are often different for founders vs employees, even if we are talking about very early employees. Founders may even be responsible for apportioning a ‘retention budget’ in order to retain key talent, however they may see fit.

My friend likes to call these hijackquisitions (hijack + acquisition). Easier to say but not as clean when written.

Though supposedly, the remaining capital in the company was enough to pay out the value of everyone else’s shares. The new (remaining?) leadership could have shut down Windsurf entirely and cashed everyone out. Supposedly.

The incentive for OpenAI to purchase the application layer is it allows them to sell tokens at a 100x markup, as "credits" (Lovable).

I think you're allocating the $2.4B wrong. It went to Windsurf the company, not to the shareholders. If Windsurf paid out the employees, they had no obligation to pay out aquihires. They could have distributed severance to all the employees until $0 remained, leaving $0 to shareholders. So his better bet was to go with the rump Windsurf and the pile of cash.